Why is a Enviromental, Social and Governance (“ESG’) Strategy Right For My Business

WHY IS A ENVIRONMENTAL, SOCIAL AND GOVERNANCE (“ESG’) STRATEGY RIGHT FOR MY BUSINESS?

The COVID-19 pandemic has made corporations review their role in society, and how their business impacts upon the environment and community. Environmental, social, and governance (ESG) issues distil this responsibility into definable elements.

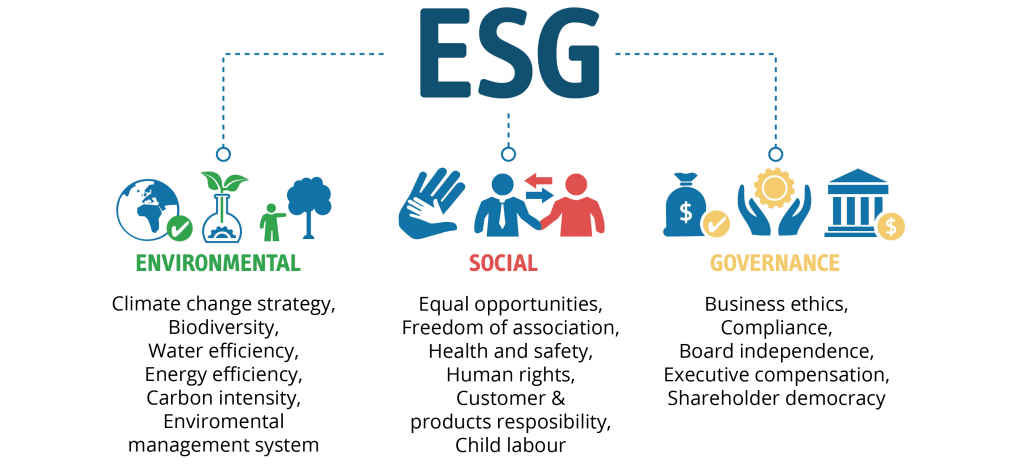

WHAT IS ESG?

Investopedia defines ESG as follows: - “Environmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. Environmental criteria consider how a company performs as a steward of nature. Social criteria examine how it manages relationships with employees, suppliers, customers, and the communities where it operates. Governance deals with a company’s leadership, executive pay, audits, internal controls, and shareholder rights.”

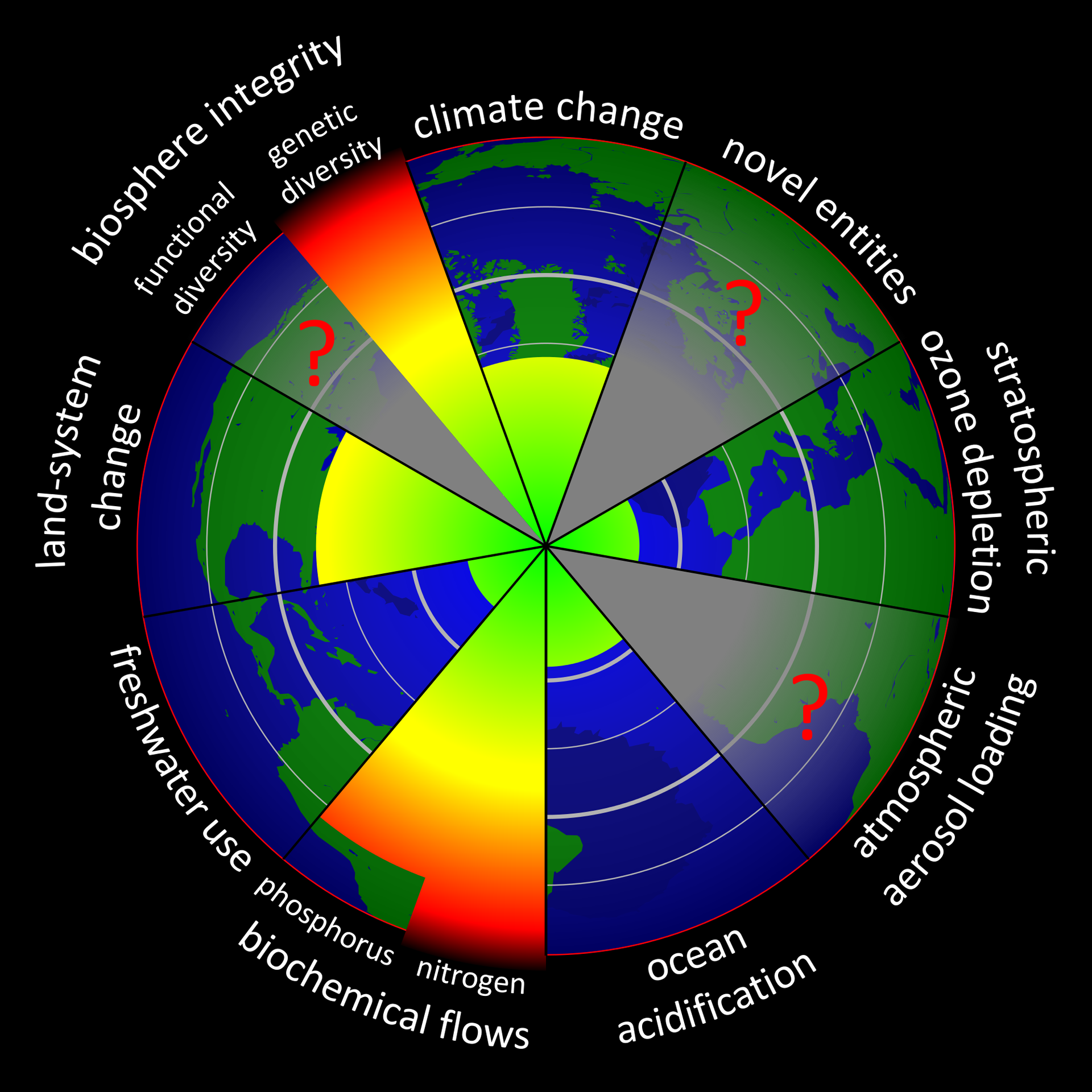

Environmental criteria include carbon emissions, and hence demonstrates how a company is proceeding toward net zero which has become an essential piece of corporate strategy.

Social criteria include how a company treats its employees and how it interfaces with its wider community. This has become increasingly visible, especially with the role of social media, specifically the relationship with its’ former employees. A positive ESG work environment makes employees and potentially ex-employees advocates for the organisation

Finally, governance is a means to effective decision-making showing investors there is a strong, sustainable ethos and governance.

BENEFITS TO THE BUSINESS?

Trust leads to Turnover Growth

A strong ESG position develops stakeholder trust in an organisation. This is seen by many as its purpose, where an organisation integrates well within its wider community, and cares about its environmental impacts. As more people trust an organisation, this feeds through to increased sales through brand association and brand loyalty.

Purpose leads to Cost Reduction

A greater focus on ESG allows organisations to consider their internal processes more deeply, increasing efficiency and reduces waste, particularly environmental harmful waste. Greater cost efficiency inevitably leads to greater profitability.

The outstanding example in this regard is 3M who launched “Pollution Prevention Pays” (3Ps) program, in 1975. To date this has generated $2.2 billion in savings [link to evidence].

Stronger ESG Leads to Increased Productivity

Stronger ESG leads to better staff retention, as well as attracting a higher calibre of employee. These employees are naturally more motivated and thus drive greater productivity and output.

As an example, when Unilever launched its 10-year Sustainable Living Plan in 2010 it became the third most popular destination for graduates behind Apple and Google. [link to data]. Unilever proceeded to outperform its rivals over the next decade through its leadership role.

Many organisations report that their sustainability web pages are the most frequently viewed after the About Us section on their websites.

Greater Return on Investment

By using ESG within project appraisals, investment can be made on a more purpose driven basis. This has proven to return greater yields on investments ensuring modern day investors can identify a strongly driven organisations and place a premium on investing.

Staying Ahead of Legal Change

By adopting an ESG approach to strategy and management, organisations are likely to be ahead of the curve for legal change. For example, in the UK most ESG driven companies will have replaced their vehicle fleets well in advance of the ban on the sale of petrol and diesel vehicles scheduled for 2030. This foresight means the legal change, which used to be disruptive for companies, now equates to a seamless change-over for ESG driven companies.

FURTHER ACTION

Please don’t hesitate to get in touch so we can discuss your requirements. No matter the size of your organisation, we can help frame how you can adopt an ESG framework to grow and nurture your business.